Contents:

Consider hiring a CPA to do a quarterly or annual “look over” of your church bookkeeping … Churches are under most of the same labor and employment laws that “for-profit” organizations are under. This includes the guidelines for classifying your workers as employees or independent contractors. Some of my clients have expressed concern regarding this method as it doesn’t show that full payment on the Statement of Activity and in turn does not show what they consider a correct “net balance”. However, I always run a Cash Flow Statement along with that report as well as a Statement of Financial Position which will show how much actual cash was actually spent for the reporting period. Laying all that aside….another important reason for keeping books…is to make good financial decisions.

- If you’re keeping your financial information in a spreadsheet currently, it’s probably time to upgrade your system.

- John has traveled the world working with prominent non-profit ministries.

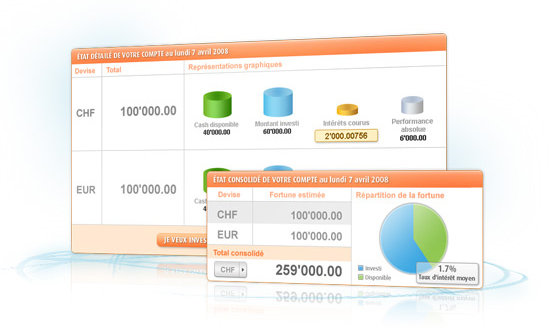

- In the above image, you can see how in general accounting, the income is recorded in the general ledger, which also indicates the amount you have for your expenses.

- Great, Steve Doud works closely with organizations of your size.

- Plus, Jitasa offers access to Quickbooks, which provides natural internal controls as you can use technology to double-check finances.

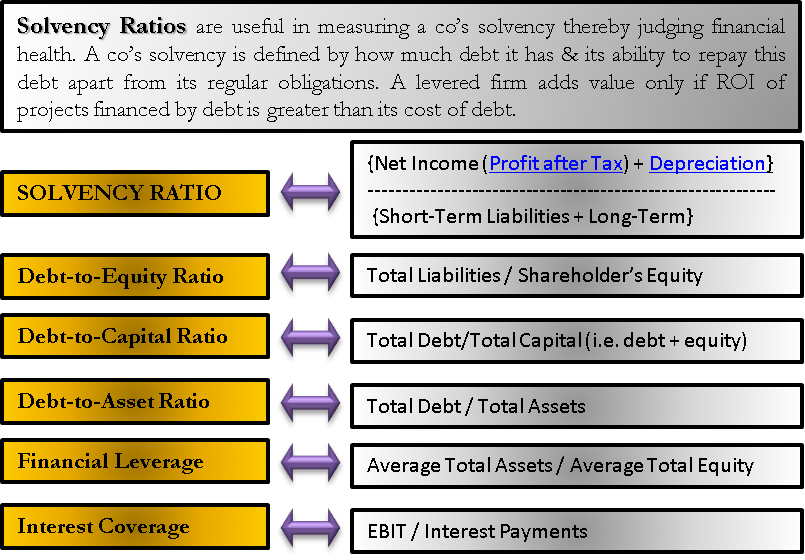

For every increase in one account, there is an opposite decrease in another. Double entry bookkeeping is require for all organizations that are required to produce a statement of its assets and liabilities . Having a monthly checklist can help ensure all financial transactions that affect your bottom line are accounted for. For example, close the month and run reports by the fifth of the following month. Here is a checklist of all the tasks to complete when closing out your bookkeeping each month.

They can assign every dollar to a committee, program, or worship fund. Offerings can be received online or in-person, using credit card, debit card, or ACH bank transfers. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

Misclassifying Workers in your Church Bookkeeping

Therefore, the polite thing to do is to respect these supporters’ wishes for how they want their contributions to be allocated at your organization. The focus of church accounting is always on advancing the mission and goals of the church itself, reinvesting all revenue back into the organization itself to advance objectives. As you can see, each of these revenue streams relies on the good nature of your church’s supporters and congregation for success.

Get help understanding these rules and the types of nonprofits. Get matched with a QuickBooks-certified bookkeeper who understands nonprofits and keeps your books up to date. Instantly create and customize key statements for official reporting, such as your Financial Position, Income, or Functional Expenses statements. Gain the power of a ministry-focused bookkeeping team at a fraction of the cost.

Knowledge to get the most out of your nonprofit

Even when restrictions aren’t placed on the contributions, they should all be reinvested back into making your organization better and more impactful. This ensures your organization is remaining respectful and responsible with the funds generously given to your church. Great, Steve Doud works closely with organizations of your size. Click the button below to schedule a day/time that works for you. Great, Cassie & Christian work closely with organizations of your size.

If you have more general questions about church presentation software, you can skip to the People Also Ask section at the bottom of the page. Or, you can jump right to the Best Keyword overviews if you’re ready to start comparing. We may earn a commission when you click through links on our site — learn more about how we aim to stay transparent. Many or all of the products featured here are from our partners who compensate us.

Your church’s leadership team and administrative staff will be able to focus on the church’s mission, not on the church’s bookkeeping. We believe everyone should be able to make financial decisions with confidence. Lisa London of “The Accountant Beside You” has created a series of online courses using step-by-step videos to show you how to use QuickBooks “effectively” for your nonprofit or church…

Donations done right

FreshBooks’ award-winning customer support means you never struggle to get assistance. You can expect a live human to answer the phone within two seconds, then zero hold time. Before a human answers, there are no endless runarounds with prerecorded messages and requests to push different buttons. You can also seek support via live chat, webinars and a knowledge base.

Understanding your church’s expenses will help you better allocate resources realistically in the future. Before you allocate funds, be sure to ask yourself how that allocation will help advance your church and your church’s mission. That way, when you run reports at your organization, the story those reports tell will show how your church uses funding responsibly. Churches, like nonprofits, rely on the generosity of their supporters to fund their organizations.

- I do this with my clients that are still handwriting paper checks, so when I do a bank reconciliation, I can send them a report and notify them if they have any outstanding checks.

- Churches can use this feature to save time , eliminate late fees and error-proof their accounting.

- Enter Breeze, a web-based church management software for small and medium-sized churches.

- Churches must provide detailed characterization of the expenses they incur.

- She is also a guide for the Profit First Professionals organization.

Sometimes, restrictions accompany these revenue sources so that certain monies must be spent on specific activities. For example, grant monies might be restricted to a scholarship program. Aplos will set up your accounting to achieve the financial reports you need. Plus, because it’s online, you and your team can run payroll on the go. We’re simply here to support you with the financial aspect of your ministry. Unlike other bookkeeping companies, we don’t charge additional setup fees.

Best for Affordable Premium Plans

The Statement of Cash Flows adjusts that “net balance” from the Statement of Activity by deducting or adding any cash transaction that involved your assets or liabilities. So using the example stated above, your SOA may show a net balance of $1,000, but the SOCF will record that $1000 and then deduct the additional $1400 you spent cash on and give you the actual net balance of -$400. Complete guide of nonprofit accounting terms and definitions. Plus, most small churches don’t need someone full time to look after their finances. Outsourcing provides an affordable option that provides churches with the expertise they need in an accountant.

This massachusetts state income tax bookkeeping software reduce the likelihood of errors. You can also save on storage, improve communication, and delegate tasks. Overall, Dext helps churches manage their finances more accurately and speedily. Administrators can tag donations to specific programs as required. By creating unique user IDs, they can allow employees, volunteers, and accounting contractors to collaborate easily.

Set reports to be automatically created and emailed to board or committee members on any schedule you’d like. Maintain your tax-free eligibility with detailed reporting and expense tracking you can access at any time. You can hunt around online or borrow one from other churches, like the Foursquare Quickbooks Church Template . You can also pay for a more advanced QuickBooks church template from an accredited accountant service like Goshen Accounting, if you want to go that route.

Enter Breeze, a web-based church management software for small and medium-sized churches. Breeze is not a full accounting software, but it does produce most of the reports your church leadership will want. If you want a full church accounting software solution — and we do recommend using one — Breeze bridges the gap between QuickBooks Premier Plus alone and more robust church-specific accounting and management software. When choosing accounting software, churches should first determine if the chosen software’s plans fit within their budget. The most affordable plan may not include all the features your church needs. Also, look to see if the chosen software offers a discount for churches and nonprofits.

Regina “Gina” Doty, 73, of Tecumseh – newschannelnebraska.com

Regina “Gina” Doty, 73, of Tecumseh.

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

Fill out the form below and one of our church plant specialists will give you a call. Simply fill out the form below, and one of our specialists will call you within 24 hours with a custom quote for your organization. This tool integrates with most major accounting providers, including Bill.com, KashFlow, and FreeAgent.

Martha Bodde Obituary (1941 – 2023) – Vermilion, OH – The Morning … – Legacy.com

Martha Bodde Obituary (1941 – – Vermilion, OH – The Morning ….

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

While I’m on a roll here….let me add that when you reconcile your bank account…there usually should not be “outstanding” deposits! By reconciling your accounting with your bank and credit card statements, you will find errors such as duplicates, missing transactions, bank errors on rare occasions, and amount discrepancies. Grant monies are often accompanied by a number of restrictions that churches must adhere to in order to remain compliant and accountable to the grant funder.

Alex loves to break down IT and financial concepts to make them easy to understand and to apply to real-life situations. In his lessons on Aplos Academy, he draws on his degree in Business Administration and experience serving at his own church. Hiring a “experienced” bookkeeper is not usually very high on a small or start up church’s list of necessities. So the Pastor either does the bookkeeping themselves or corrals a member/volunteer with some “financial” or “organizational” skills and turns it over to them. One of the best practices is to reconcile your bank and credit card accounts MONTHLY.