In all subsequent months, cash from operations would be $0 as each $100 increment in net income would be offset by a corresponding $100 decrease in current liabilities (the deferred revenue account). Under the cash basis of accounting, deferred revenue and expenses are not recorded because income and expenses are recorded as the cash comes in or goes out. This makes the accounting easier, but isn’t so great for matching income and expenses. Learn more about choosing the accrual vs. cash basis method for income and expenses. Generally accepted accounting principles (GAAP) require certain accounting methods and conventions that encourage accounting conservatism. Accounting conservatism ensures the company is reporting the lowest possible profit.

- For example, the legal profession requires lawyers to deposit unearned fees into an IOLTA trust account to satisfy their fiduciary and ethical duty.

- The balance is now $0 in the deferred revenue account until next year’s prepayment is made.

- Level up your career with the world’s most recognized private equity investing program.

- Instead, you will record them on balance sheet accounts as liabilities (or assets for expenses) until you earn or use them.

As a result, the golf club has met its obligation to provide golf club benefits for a complete year in one month (1/12th). Get instant access to video lessons taught by experienced Deferred Revenue Definition investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Read our article to learn more about Accrual vs. Cash Basis Accounting.

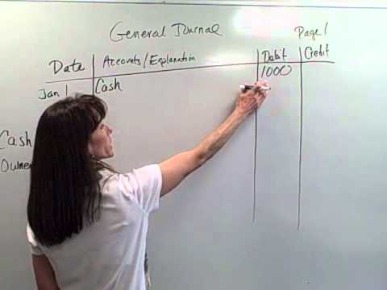

How to account for deferred revenue

Thus, they are items on a balance sheet you initially enter as a liability (an obligation to fulfill in the future) but later become an asset. Deferred revenue is common with subscription-based products or services that require prepayments. Examples of unearned revenue are rent payments received in advance, prepayment received for newspaper https://kelleysbookkeeping.com/liability-definition-and-meaning/ subscriptions, annual prepayment received for the use of software, and prepaid insurance. Yes, deferred revenue should be categorised as a liability, rather than an asset, on your business’s balance sheet. This is because it describes revenue that hasn’t been earned, and therefore represents a product/service that is owed to the customer.

The payment is considered a liability to the company because there is still the possibility that the good or service may not be delivered, or the buyer might cancel the order. In either case, the company would need to repay the customer, unless other payment terms were explicitly stated in a signed contract. So, if Company A receives the $15,000 on July 1 and begins work on July 6, they’ll record a debit of $15,000 to cash and a credit of $15,000 to deferred revenue. At this point, the balance sheet will show a current liability of $15,000.

Terms Similar to Deferred Revenue

In accrual accounting, revenue is only recognized when it is earned. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability on its balance sheet. Deferred revenue is recognized as a liability on the balance sheet of a company that receives an advance payment. This is because it has an obligation to the customer in the form of the products or services owed.

Zscaler Expects to Report Third-Quarter Results above Guidance … – GlobeNewswire

Zscaler Expects to Report Third-Quarter Results above Guidance ….

Posted: Mon, 08 May 2023 07:00:00 GMT [source]

The deferred revenue account is normally classified as a current liability on the balance sheet. It can be classified as a long-term liability if performance is not expected within the next 12 months. Unlike accounts receivable (A/R), deferred revenue is classified as a liability, since the company received cash payments upfront and has unfulfilled obligations to its customers. Gradually, as the product or service is delivered to the customers over time, the deferred revenue is recognized proportionally on the income statement.

How Do Businesses Acquire Deferred Revenue?

Typically, deferred revenue is listed as a “current” liability on the balance sheet due to prepayment terms ordinarily lasting fewer than twelve months. Just because you have received deferred revenue in your bank account does not mean your clients will not ask for a refund in the future. Additionally, some industries have strict rules governing how to treat deferred revenue. For example, the legal profession requires lawyers to deposit unearned fees into an IOLTA trust account to satisfy their fiduciary and ethical duty. The penalties for non-compliance can be harsh—sometimes leading to disbarment. Deferred revenue is the revenue you expect from a booking, but you are yet to deliver on the account’s agreement.

Once generated, revenue is recognized and recorded as revenue rather than being postponed. Deferred revenue refers to money you receive in advance for products you will supply or services you will perform in the future. For example, annual subscription payments you receive at the beginning of the year or rent payments you receive in advance.